横浜の海沿いに位置する地域には、多くの人々に愛されているスポットが集まっている。 “みなとみらいで考える健康管理の重要性” の続きを読む

みなとみらい健康の拠点と未来

横浜市の海に面した地域には、現代的な都市景観が広がる場所があり、多くの人々が訪れる観光スポットとして知られている。 “みなとみらい健康の拠点と未来” の続きを読む

みなとみらいの医療が支える健康な未来

みなとみらいは、この地域の持つ独自の魅力とともに、多様なサービスを展開している場所である。 “みなとみらいの医療が支える健康な未来” の続きを読む

みなとみらいの医療環境と未来

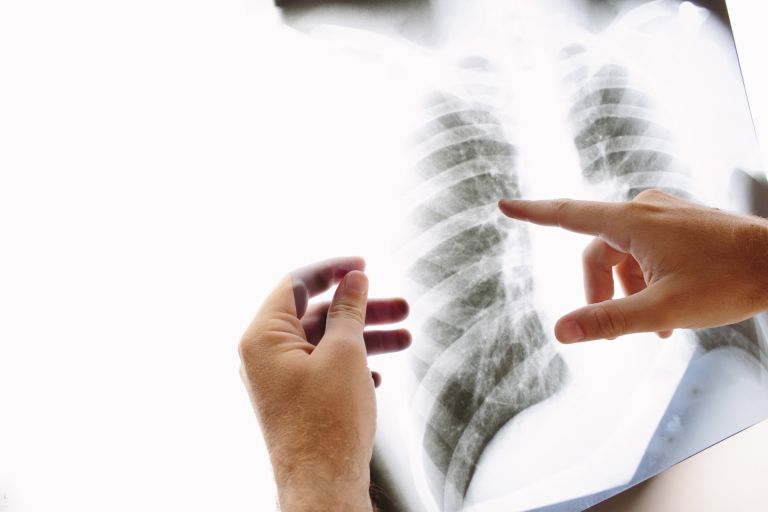

ある都市の魅力は、その景観や文化、そして医療環境によっても大きく影響される。 “みなとみらいの医療環境と未来” の続きを読む

みなとみらい健康支援の地域づくり

医療は人々の生活に欠かせない根幹を成す重要な要素であり、その整備や質の向上が地域社会の健康を支える基盤となります。 “みなとみらい健康支援の地域づくり” の続きを読む